Types of Banks

UNIVERSAL BANK

It is financial supermarket where all financial products are sold under one roof.

• It is a system of banking where bank undertake a blanket of financial services like investment banking, commercial banking, development banking, insurance and other financial services including functions of merchant banking, mutual funds, factoring, housing finance etc.

• As per the World Bank, the definition of the Universal Bank is as follows: In Universal banking, the large banks operate extensive network of branches, provide many different services, hold several claims on firms (including equity and debt) and participate directly in the Corporate Governance of firms that rely on the banks for funding or as insurance underwriters.

• The second Narasimham committee of 1998 gave an introductory remark on the concept of the Universal banking, as a different concept than the Narrow Banking. Narsimham Committee II suggested that Development Financial Institutions (DFIs) should convert ultimately into either commercial banks or non-bank finance companies.

• However, the concept of Universal Banking conceptualized in India after the RH Khan Committee recommended it as a different concept. The Khan Working Group held the view that DFIs (Development Finance Institutions) should beallowed to become banks at the earliest.

Advantages of Universal Banking

• Increased diversions and increased profitability.

• Better Resource Utilization.

• Brand name leverage.

• Existing clientele leverage.

• Value added services.

• ‘One-stop shopping’ saves a lot of transaction costs.

• Easy Marketing

• Profit Diversification

• Increased diversions and increased profitability.

• Better Resource Utilization.

• Brand name leverage.

• Existing clientele leverage.

• Value added services.

• ‘One-stop shopping’ saves a lot of transaction costs.

• Easy Marketing

• Profit Diversification

DEVELOPMENT BANK

• Development bank is essentially a multi-purpose financial institution with a broad development outlook.

• A development bank may, thus, be defined as a financial institution concerned with providing all types of financial assistance (medium as well as long term) to business units, in the form of loans, underwriting, investment and guarantee operations, and promotional activities — economic development in general, and industrial development, in particular.

• Development bank is essentially a multi-purpose financial institution with a broad development outlook.

• A development bank may, thus, be defined as a financial institution concerned with providing all types of financial assistance (medium as well as long term) to business units, in the form of loans, underwriting, investment and guarantee operations, and promotional activities — economic development in general, and industrial development, in particular.

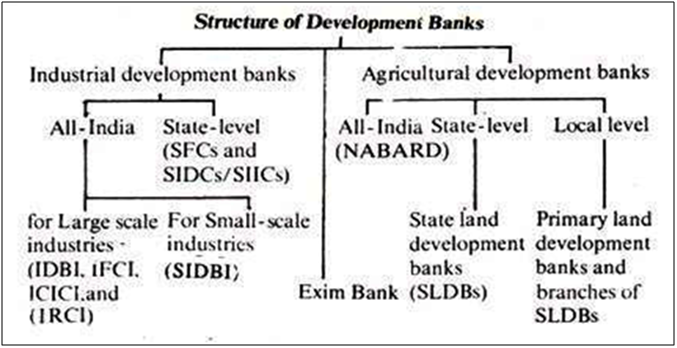

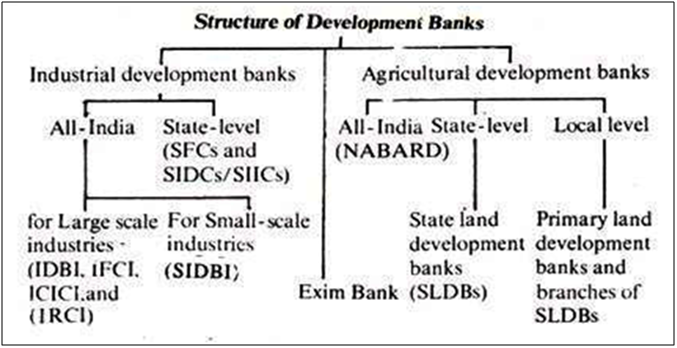

Development banks in India are classified into following four groups:

Industrial Development Banks: It includes, for example, Industrial Finance Corporation of India (IFCI), Industrial Development Bank of India (IDBI), and Small Industries Development Bank of India (SIDBI).

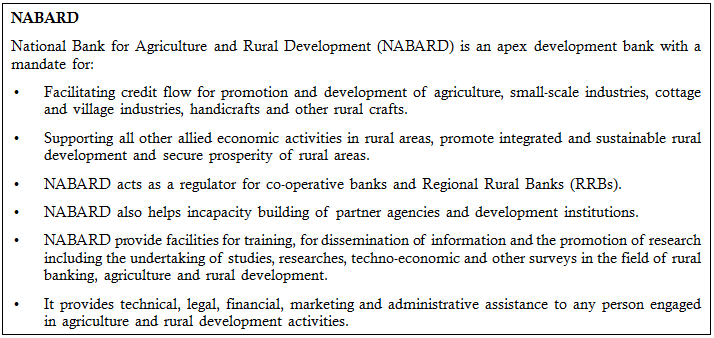

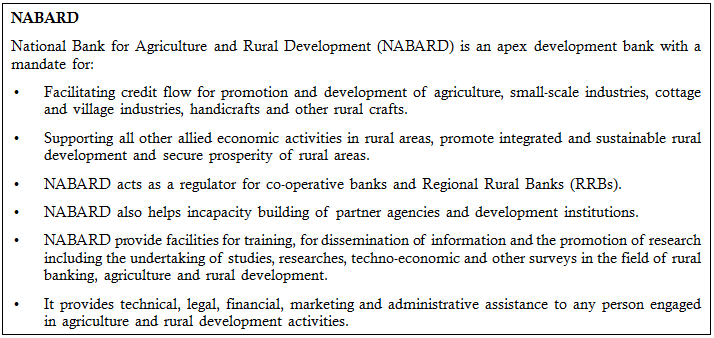

Agricultural Development Banks: It includes, for example, National Bank for Agriculture & Rural Development (NABARD).

Export-Import Development Banks: It includes, for example, Export-Import Bank of India (EXIM Bank).

Housing Development Banks: It includes, for example, National Housing Bank (NHB).

Industrial Development Banks: It includes, for example, Industrial Finance Corporation of India (IFCI), Industrial Development Bank of India (IDBI), and Small Industries Development Bank of India (SIDBI).

Agricultural Development Banks: It includes, for example, National Bank for Agriculture & Rural Development (NABARD).

Export-Import Development Banks: It includes, for example, Export-Import Bank of India (EXIM Bank).

Housing Development Banks: It includes, for example, National Housing Bank (NHB).

LEAD BANK

Introduced in 1969, based on the recommendations of the Gadgil Study Group on the organizational framework for the implementation of social objectives.

Introduced in 1969, based on the recommendations of the Gadgil Study Group on the organizational framework for the implementation of social objectives.

Objectives of Lead Bank Scheme:

• Eradication of unemployment and under employment

• Appreciable rise in the standard of living for the poorest of the poor

• Provision of some of the basic needs of the people who belong to poor sections of the society.

• Eradication of unemployment and under employment

• Appreciable rise in the standard of living for the poorest of the poor

• Provision of some of the basic needs of the people who belong to poor sections of the society.

Area Approach

• The basic idea was to have an “area approach” for targeted and focused banking.

• The banker’s committee, headed by S. Nariman, concluded that districts would be the units for area approach and each district could be allotted to a particular bank which will perform the role of a Lead Bank.

• The Lead bank Scheme was not fully able to achieve its targets due to shift in policies, complexities in operations, lack of cooperation among various financial institutions and issues shifting to the Financial Inclusion.

• There was a strong need felt to revitalize the scheme with clear guidelines on respecting the bankers’ commercial judgements even as they fulfill their sectoral targets.

• The Government of India constituted a High-Power Committee headed by Mrs. Usha Thorat, Deputy Governor of the RBI, to suggest reforms in the LBS. The task of this penal was to recommend how to revitalize the LBS, given the challenges facing the banking sector, especially in an era of increasing privatization and autonomy.

• The basic idea was to have an “area approach” for targeted and focused banking.

• The banker’s committee, headed by S. Nariman, concluded that districts would be the units for area approach and each district could be allotted to a particular bank which will perform the role of a Lead Bank.

• The Lead bank Scheme was not fully able to achieve its targets due to shift in policies, complexities in operations, lack of cooperation among various financial institutions and issues shifting to the Financial Inclusion.

• There was a strong need felt to revitalize the scheme with clear guidelines on respecting the bankers’ commercial judgements even as they fulfill their sectoral targets.

• The Government of India constituted a High-Power Committee headed by Mrs. Usha Thorat, Deputy Governor of the RBI, to suggest reforms in the LBS. The task of this penal was to recommend how to revitalize the LBS, given the challenges facing the banking sector, especially in an era of increasing privatization and autonomy.

The following were the recommendation of Usha Thorat Committee on Lead Banks

• LBS should be continued to accelerate financial inclusion in the unbanked areas of the country.

• Private sector banks should be given a greater role in LBS action plans, particularly in areas of their presence.

• Enhance the business correspondent model, making banking services available in all villages having a population of above 2,000 and relaxation in KYC (know your customer) norms for small value accounts.

• There is a strong need to revamp and revitalise the Lead Bank Scheme so as to make it an effective instrument for bringing about meaningful co-ordination among banks operating in various part of the country.

• LBS should be continued to accelerate financial inclusion in the unbanked areas of the country.

• Private sector banks should be given a greater role in LBS action plans, particularly in areas of their presence.

• Enhance the business correspondent model, making banking services available in all villages having a population of above 2,000 and relaxation in KYC (know your customer) norms for small value accounts.

• There is a strong need to revamp and revitalise the Lead Bank Scheme so as to make it an effective instrument for bringing about meaningful co-ordination among banks operating in various part of the country.

PAYMENT BANK

• A payments bank is like any other bank, but operating on a smaller scale without involving any credit risk.

• In simple words, it can carry out most banking operations but can’t advance loans or issue credit cards.

• It can accept demand deposits (up to Rs 1 Lakh), offer remittance services, mobile payments/transfers/purchases and other banking services like ATM/debit cards, net banking and third party fund transfers.

• The NachiketMor committee appointed by RBI to propose measures for achieving financial inclusion and increased access to financial services in 2013.The committee submitted its report suggesting creation of specialized bank or Payment Bank to cater the lower income groups and small businesses so that by Jan 2016, each Indian resident can have a global bank account.

• A payments bank is like any other bank, but operating on a smaller scale without involving any credit risk.

• In simple words, it can carry out most banking operations but can’t advance loans or issue credit cards.

• It can accept demand deposits (up to Rs 1 Lakh), offer remittance services, mobile payments/transfers/purchases and other banking services like ATM/debit cards, net banking and third party fund transfers.

• The NachiketMor committee appointed by RBI to propose measures for achieving financial inclusion and increased access to financial services in 2013.The committee submitted its report suggesting creation of specialized bank or Payment Bank to cater the lower income groups and small businesses so that by Jan 2016, each Indian resident can have a global bank account.

Objectives of Payment Bank

• To widen the spread of payment and financial services to small businesses, low income households, migrant labour workforce in secured technology driven environment.

• With payments banks, RBI seeks to increase the penetration level of financial services to the remote areas of the country.

• To widen the spread of payment and financial services to small businesses, low income households, migrant labour workforce in secured technology driven environment.

• With payments banks, RBI seeks to increase the penetration level of financial services to the remote areas of the country.

SMALL FINANCE BANK

Small finance banks are a type of niche banks in India. The main purpose of the small banks will be to provide a whole suite of basic banking products such as bank deposits and supply of credit, but in a limited area of operation. The objective for these Small Banks is to increase financial inclusion by provision of savings vehicles to under-served and unserved sections of the population, supply of credit to small farmers, micro and small industries, and other unorganized sector entities through high technology-low cost operations.

Small finance banks are a type of niche banks in India. The main purpose of the small banks will be to provide a whole suite of basic banking products such as bank deposits and supply of credit, but in a limited area of operation. The objective for these Small Banks is to increase financial inclusion by provision of savings vehicles to under-served and unserved sections of the population, supply of credit to small farmers, micro and small industries, and other unorganized sector entities through high technology-low cost operations.

RBI guidelines about small bank includes:

• The firms must have a capital of Indian Rupees 100 crore. Existing Non-Banking Financial Companies (NBFC), Micro-Finance Institutions (MFI) and Local Area Banks (LAB) are allowed to set up small finance banks.

• The Corporate Promoter should have 10 years experience in banking and finance.

• The promoters stake in the paid-up equity capital will be 40% initially which must be brought down to 26% in 12 years. Joint ventures are not permitted.

• Foreign share holding will be allowed in these banks as per the rules for Foreign Direct Investment in private banks in India.

• The banks will not be restricted to any region. 75% of its net credits should be in priority sector lending and 50% of the loans in its portfolio must in 25 lakh range.

• The bank shall primarily undertake basic banking activities of accepting deposits and lending to small farmers, small businesses, micro and small industries, and unorganized sector entities. It cannot set up subsidiaries to undertake non-banking financial services activities. After the initial stabilization period of 5 years, and after a review, the RBI may liberalize the scope of activities for Small Banks.

• Small Banks have to meet RBI’s norms and regulations regarding risk management. They have to meet CRR, SLR, Repo rate and reverse repo rate requirements, like any other commercial bank.

• The maximum loan size and investment limit exposure to single/group borrowers/issuers would be restricted to 15% of capital funds.

• For the first 3 years, 25% of branches should be in unbanked rural areas.

• The firms must have a capital of Indian Rupees 100 crore. Existing Non-Banking Financial Companies (NBFC), Micro-Finance Institutions (MFI) and Local Area Banks (LAB) are allowed to set up small finance banks.

• The Corporate Promoter should have 10 years experience in banking and finance.

• The promoters stake in the paid-up equity capital will be 40% initially which must be brought down to 26% in 12 years. Joint ventures are not permitted.

• Foreign share holding will be allowed in these banks as per the rules for Foreign Direct Investment in private banks in India.

• The banks will not be restricted to any region. 75% of its net credits should be in priority sector lending and 50% of the loans in its portfolio must in 25 lakh range.

• The bank shall primarily undertake basic banking activities of accepting deposits and lending to small farmers, small businesses, micro and small industries, and unorganized sector entities. It cannot set up subsidiaries to undertake non-banking financial services activities. After the initial stabilization period of 5 years, and after a review, the RBI may liberalize the scope of activities for Small Banks.

• Small Banks have to meet RBI’s norms and regulations regarding risk management. They have to meet CRR, SLR, Repo rate and reverse repo rate requirements, like any other commercial bank.

• The maximum loan size and investment limit exposure to single/group borrowers/issuers would be restricted to 15% of capital funds.

• For the first 3 years, 25% of branches should be in unbanked rural areas.

No comments:

Post a Comment